AI Powered Chatbot

Project length

1.5 months

My role

Lead designer

Problem area

Customer service calls are costing Morgan Stanley ~$37mm per year.

Solution

A generative AI powered chatbot that can resolve customer service inquiries without requiring human intervention.

Define

The product

E*TRADE is a financial institution that primarily services self-directed clients with Brokerage accounts looking to engage in active trading of stocks and options.

The experience

The E*TRADE Virtual Assistant (ETVA) is a limited chatbot that is only capable of generically surfacing responses to FAQ’s.

Key stats

The problem

In 2024, service call volume grew 13%, while our client base only grew 4.5%.

The cost of service grew from $34mm in 2023 to $37mm in 2024.

The opportunity

~50% of clients who contact customer service look for digital support prior to calling.

We’ve estimated that an $8mm investment into an AI powered bot will result in a savings of $50mm in service costs over the next 3-5 years.

The strategic approach

Problem area(s)

Clients (particularly new ones) have difficulty navigating and understanding the current experience.

Competitive products are significantly more robust, offering more insights, tools and raw data.

Design strategy

Restructure the IA/Navigation to be less daunting for new clients

Offer customization features that help clients narrow the broad scope of Markets data to suit their individual needs.

Conduct a competitive audit and fill feature gaps.

Thoughtfully integrate ET Web features to expand our overall Mobile offering.

Design

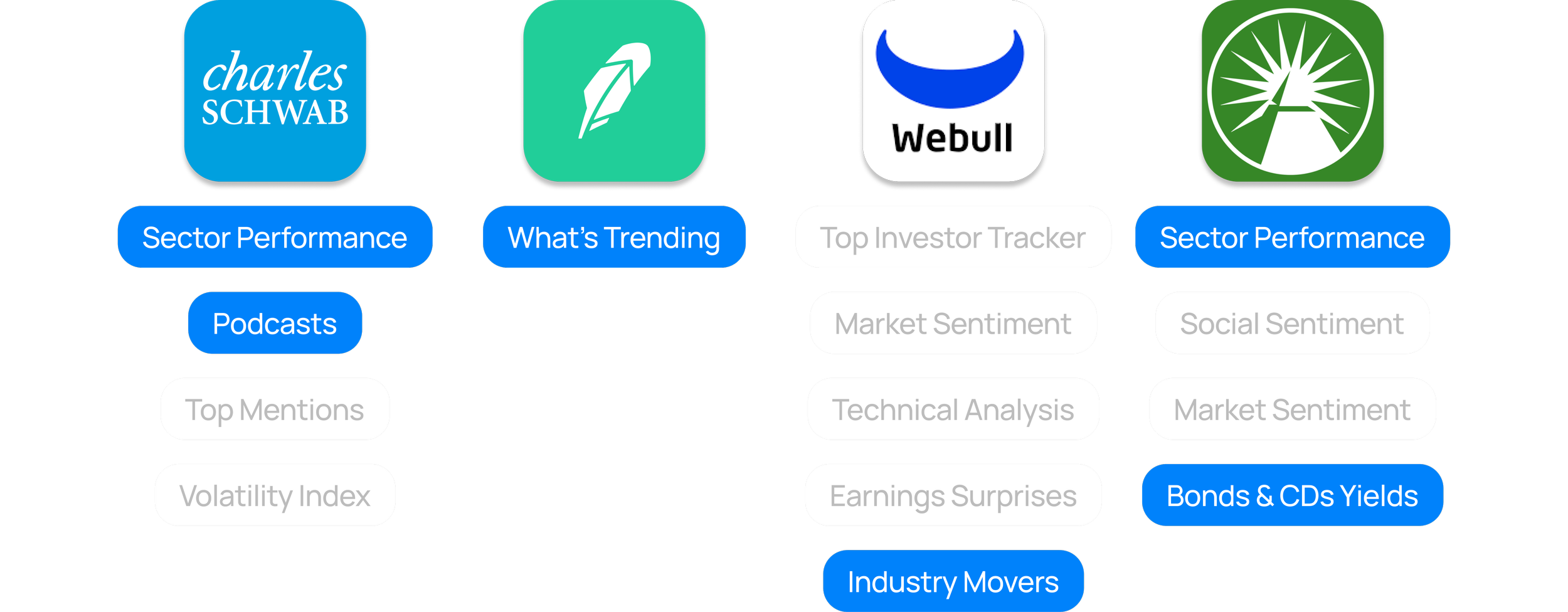

Competitive analysis

We audited the ‘Markets’ experiences of 4 competitors to identify gaps that we could seamlessly integrate into the ETM experience.

Feature prioritization

Next, we made a list of all of the possible features we could design for and prioritized them based on our platform strategy, capabilities and competitive insights.

Information architecture

Knowing users found the existing IA confusing, we set out to restructure the page, starting with the Overview tab.

The goal here was to make more feel like less. To accomplish this, we applied the principle of ‘proximity’, grouping related content within condensed cards.

Design challenges & solutions

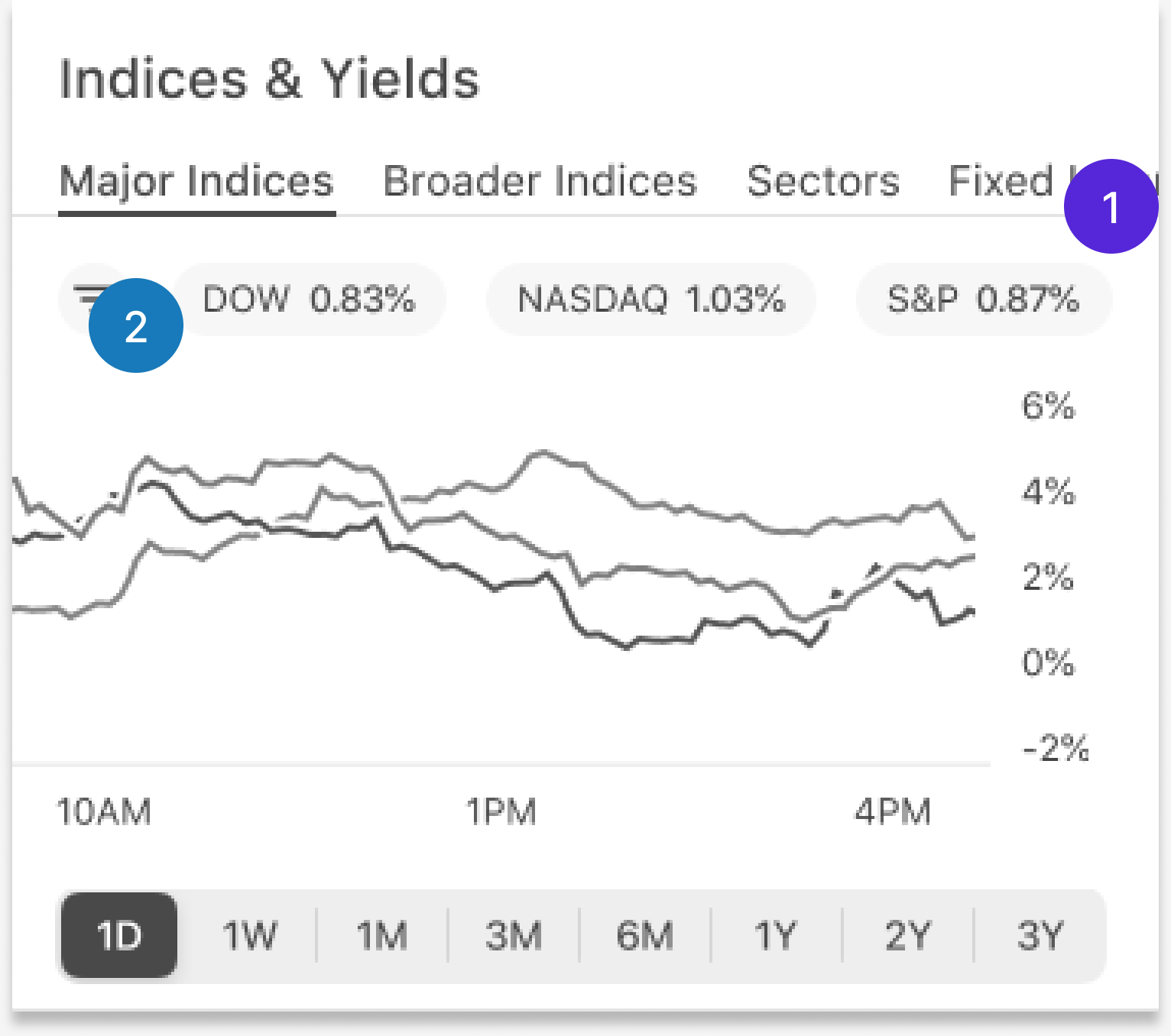

Starting with the ‘Indices and Yields’ card, we faced 2 major design challenges:

A scalable selector that would allow us to fit the 7 different categories of indices/yields into a Mobile card.

A pattern that enabled users to swap indices in and out of their view.

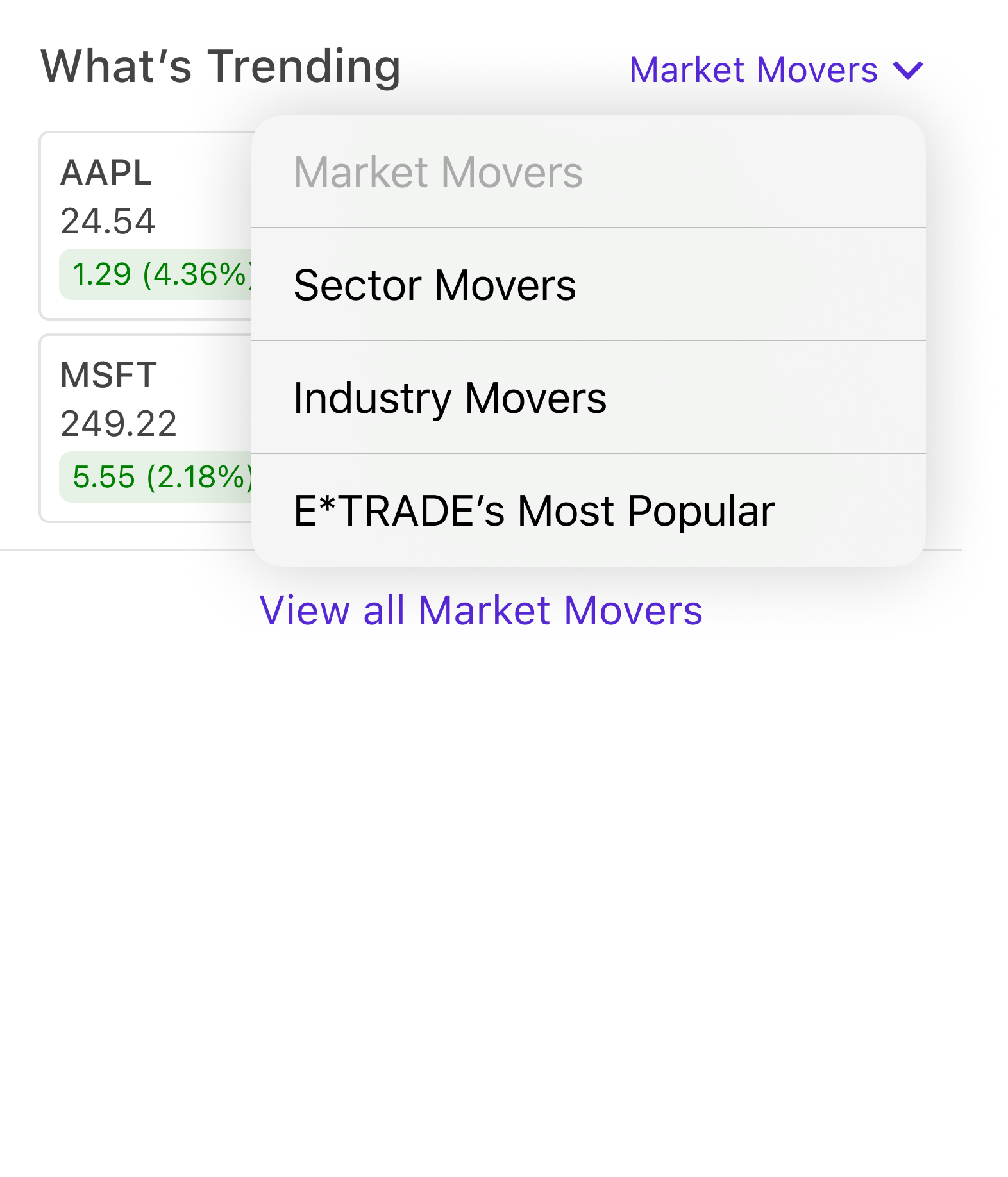

After a few rounds of iterations we decided to utilize a native menu for both interactions.

The indices would be edited using an ellipses icon, while the views could be changed by a trailing dropdown in the header.

This approach proved to be scalable while offloading irrelevant content, further focusing the user’s attention and reducing cognitive load.

We then applied the same pattern to the rest of the page.

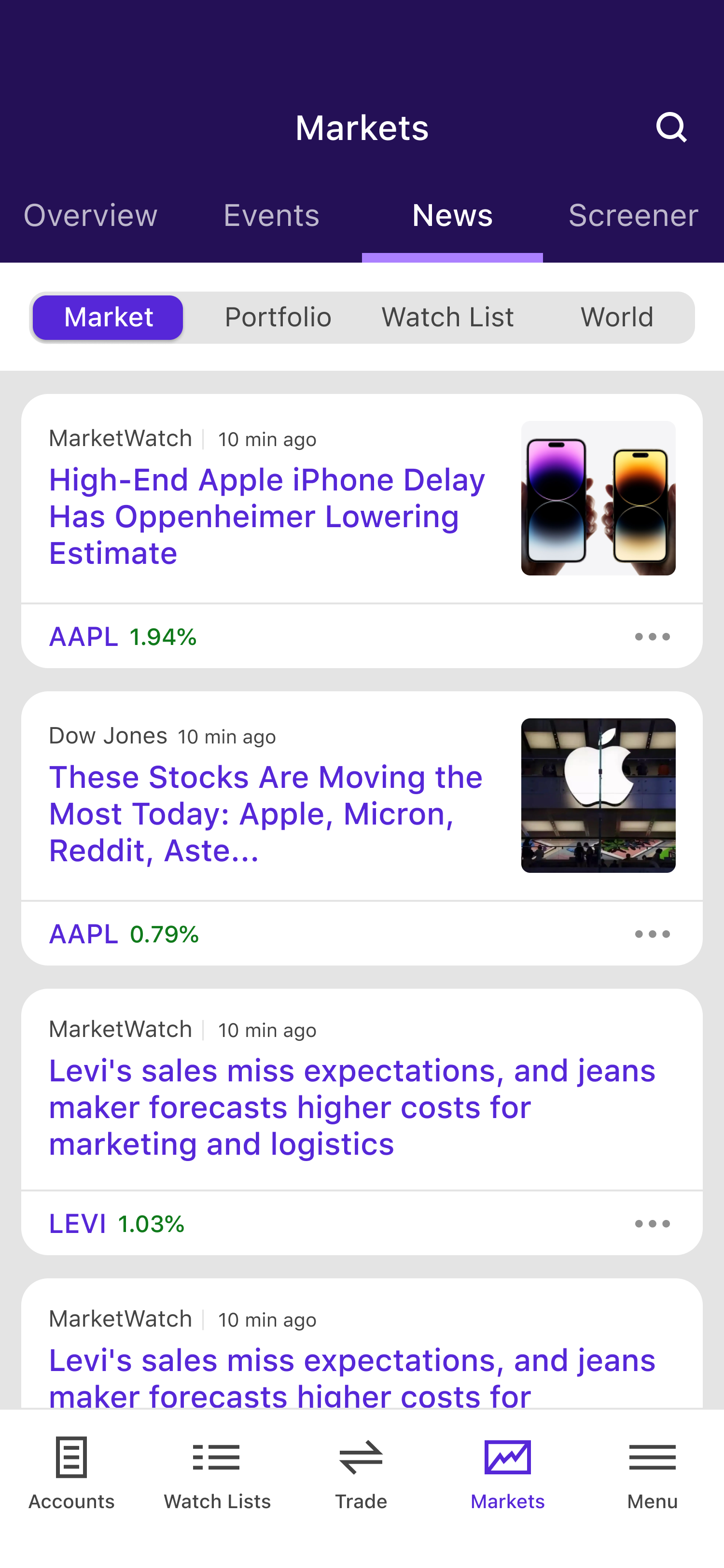

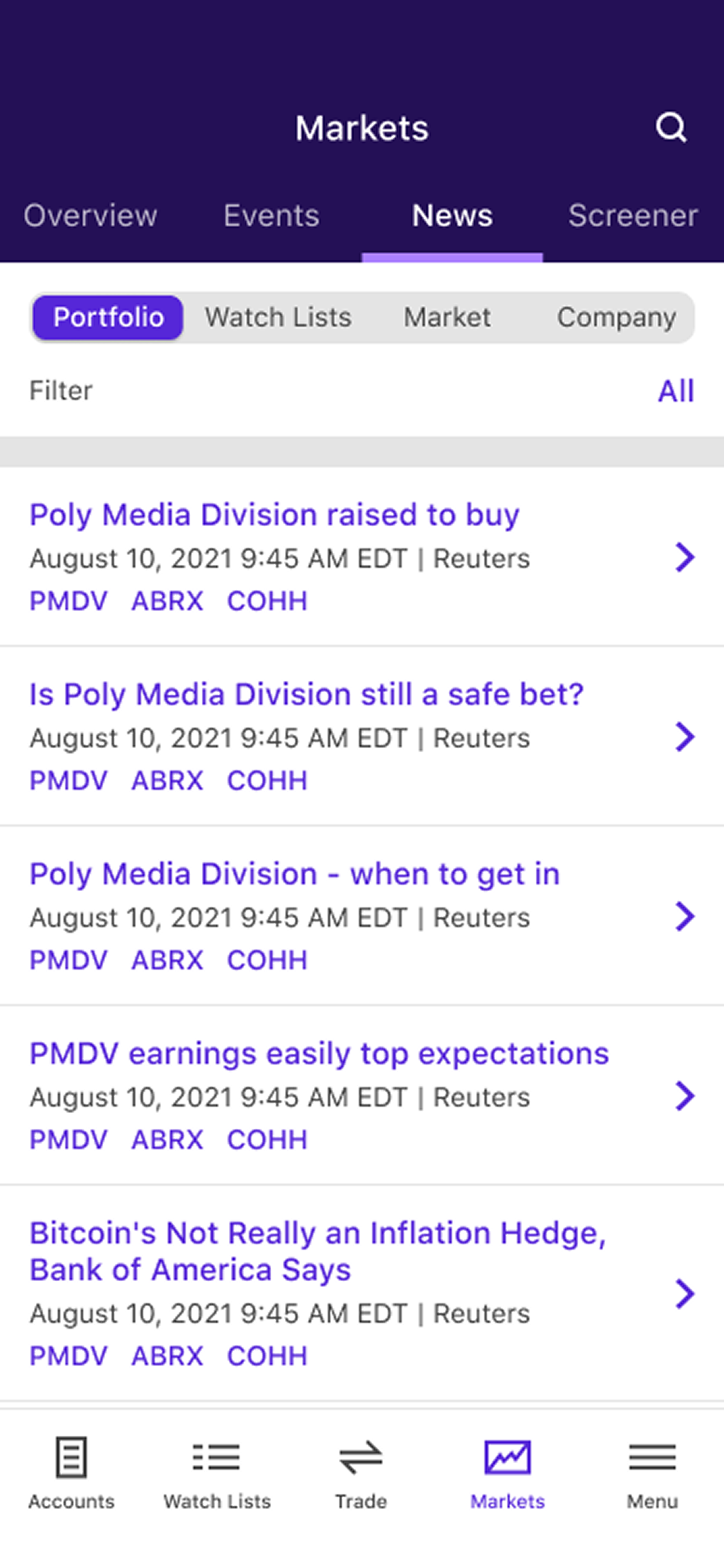

Once the ‘Overview’ page was complete, we dove into the 3 remaining tabs, sticking to our overarching strategy of reducing cognitive load while filling feature gaps.

Before

After

After

Before

After

Before

Deliver

Strategic wrap-up

When delivering the final designs, it was important to tie each of our design decisions back to our overarching strategy.

Strategy

Redesign the information architecture to be less daunting for new clients.

Solution

Grouped previously scattered modules into condensed cards with related content.

Strategy

Offer customization features that help clients narrow the broad scope of Markets data to suit their needs.

Solution

Introduced the ability to set default tabs on the ‘Overview’ page and remove/reorder cards.

Strategy

Fill competitive feature gaps.

Solution

Conducted a competitive audit and designed accordingly.

Added an ‘E*TRADE’s Most Popular’ section, similar to Robinhood’s ‘Trending List’.

Added sector and industry specific data, similar to Fidelity’s experience.

Strategy

Thoughtfully integrate ET Web features to expand our overall Mobile offering.

Solution

Added new content such as Podcasts and ‘Behind the Move’ to further enhance our entertainment and news offerings.

Expanded our indices and yields data to include foreign currencies, commodities, and treasury bills, thus allowing us to accommodate a wider range of clients.

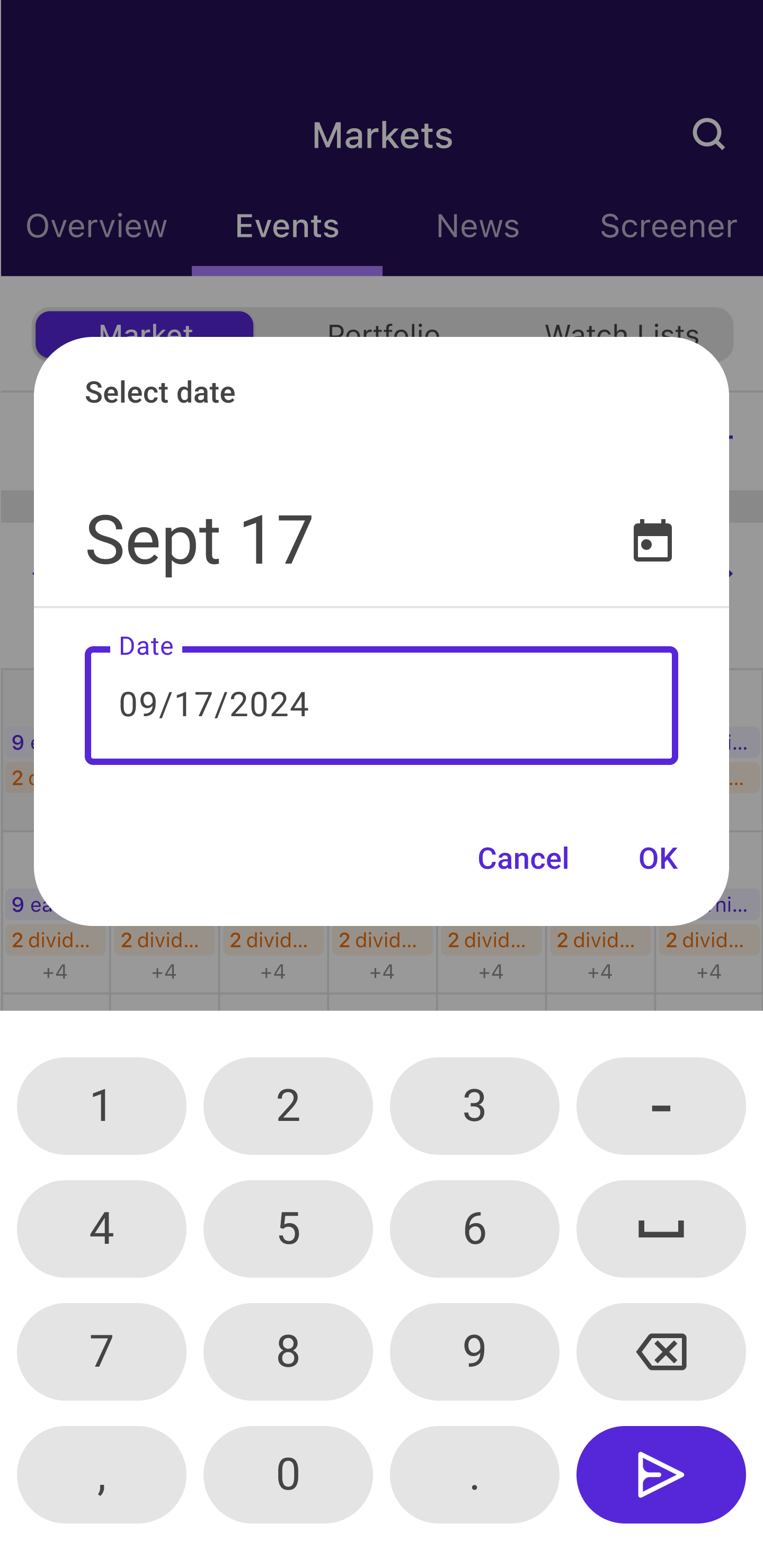

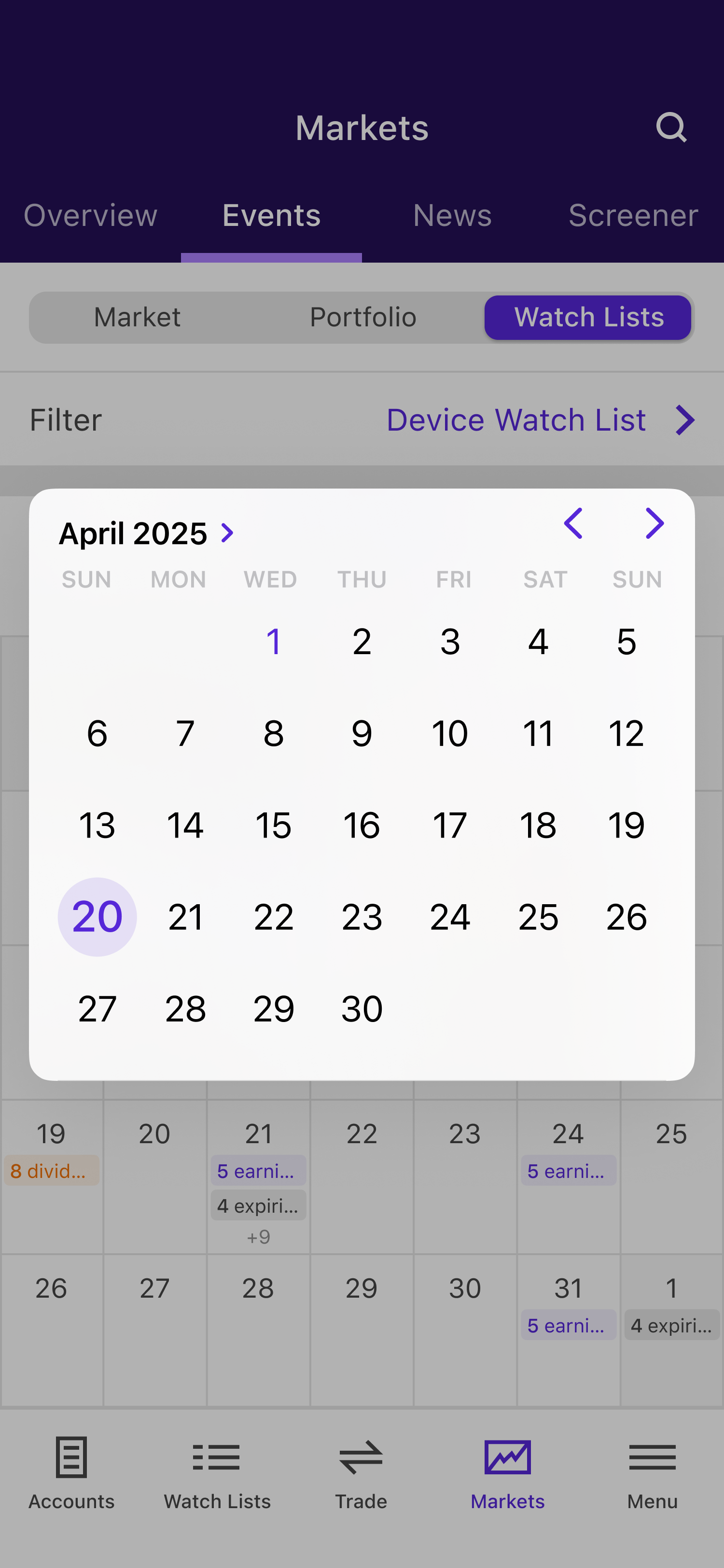

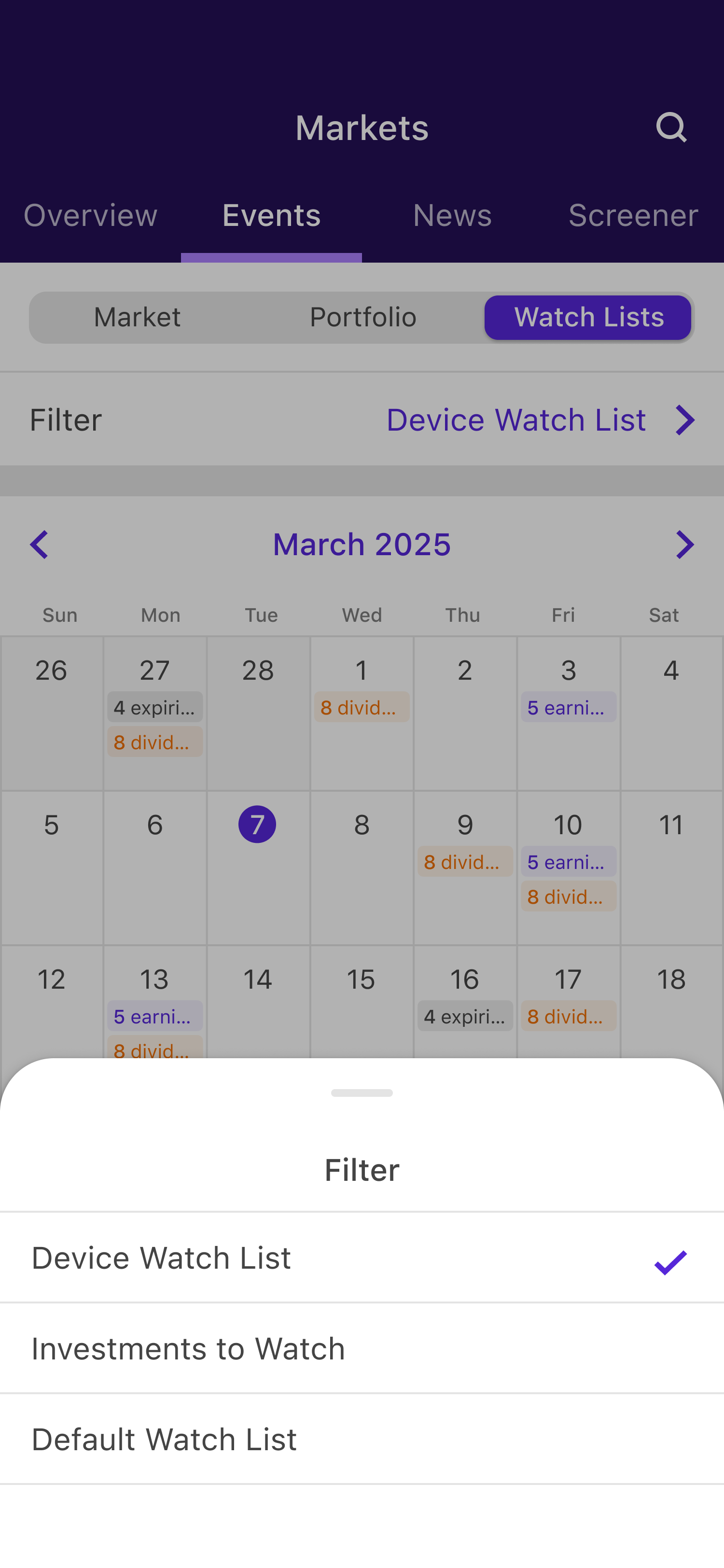

Design delivery

Lastly, we delivered native designs for each of the respective operating systems, including tablet and dark mode.

Android Date Picker

iOS Date Picker

iOS Half Sheet

Next steps

Phase 1 of the Markets experience is expected to be released in October 2025, with the remaining work being delivered in 2026.

Since the completion of this work, we have integrated Crypto trading and market data within the app. The scalable foundation of this design proved to be useful, as it easily scaled to accommodate our new Crypto specific requirements.